After a decade shaped by speculative trading, volatile cycles, and regulatory uncertainty, the global crypto market has begun to mature. The story of 2025 isn’t about bull runs or meme tokens, it’s about the rise of regulation as a defining force.

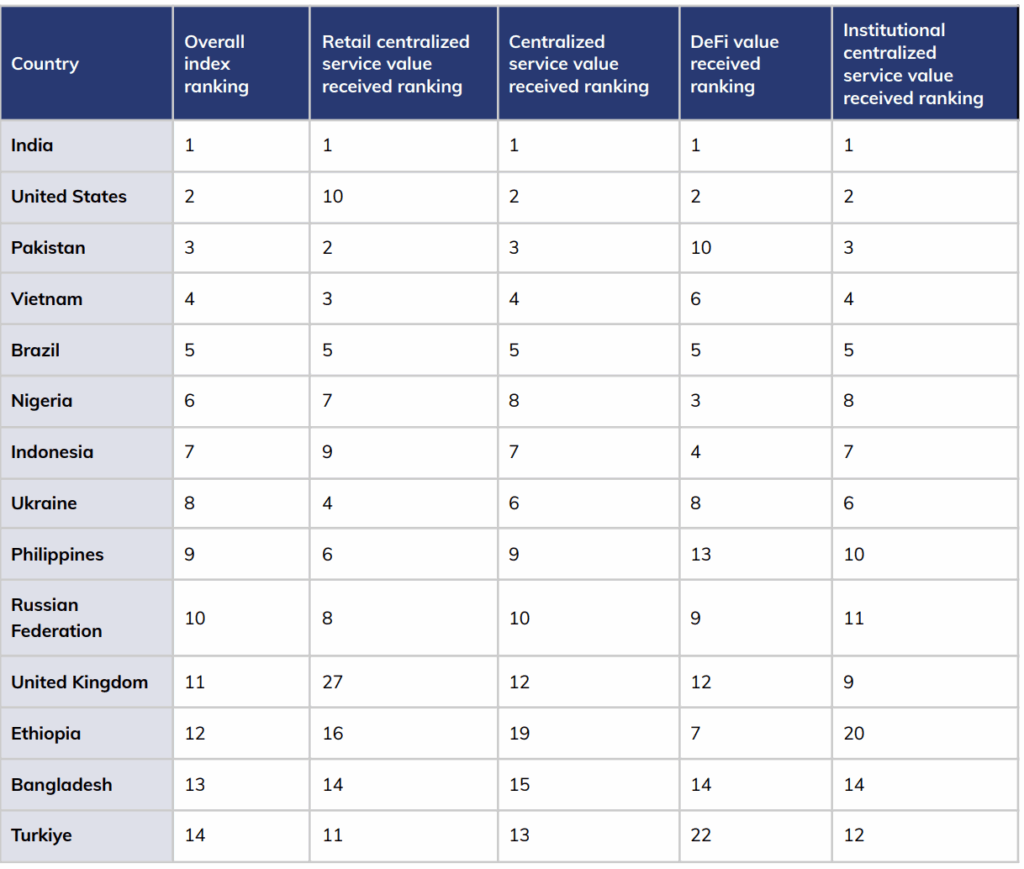

Data from Chainalysis’ 2025 Geography of Crypto Report shows a striking trend: the countries leading global crypto adoption are not those with the loosest oversight, but the ones with the clearest rules.

From India (#1) and the United States (#2) to Brazil (#5) and Indonesia (#7), markets that have embraced transparent frameworks for taxation, licensing, and compliance are now seeing both user participation and institutional inflows accelerate.

This marks a turning point for the industry. What was once viewed as a clash between innovation and oversight has evolved into a form of coordination. Regulation is no longer the barrier to growth, it’s the bridge that connects crypto with the real economy.

From Regulatory Risk to Economic Strategy

A decade ago, crypto adoption was driven by communities operating outside the system. Today, it is being pulled into the center of the financial map. Governments are not only reacting to crypto, they’re designing around it.

Chainalysis ranked 151 countries by on-chain activity, and nine of the top ten operate under defined or emerging regulatory regimes. The Asia-Pacific (APAC) region now leads global growth, with crypto transaction values up 69% year-over-year, representing nearly a third of total global volume. Meanwhile, Brazil (#5) and Japan (#19), both known for institutional-grade oversight, recorded triple-digit annual growth.

What used to be a world of parallel systems, traditional finance on one side, crypto on the other, is now merging into one shared architecture. Regulation isn’t slowing that convergence down; it’s making it possible.

Read more: Bank Indonesia Plans to Release Stablecoin Backed by Government Bonds

United States: Wall Street Meets Web3

The United States is the clearest example of how regulation can catalyze institutional momentum. In 2025, the passage of the GENIUS Act, America’s first federal stablecoin framework, and the approval of spot Bitcoin ETFs transformed digital assets from an alternative investment into a recognized financial product.

These two milestones rewired the relationship between crypto and capital markets. Institutional transfers now account for 45% of all U.S. on-chain activity, while tokenized U.S. Treasuries, a sector that barely existed two years ago, have expanded to US$7 billion in assets under management.

The change isn’t just regulatory, it’s cultural. The U.S. no longer sees crypto as a threat to its financial system, but as an extension of it. Wall Street didn’t walk away when the rules arrived; it stepped in, with confidence.

Read more: Trump’s 2025 Tariffs Shake Markets — What It Means for Crypto and Indonesia

Europe: Regulation by Design

Europe took a slower, more deliberate approach, but one that may prove more durable in the long run. The Markets in Crypto-Assets (MiCA) framework, which came into effect in late 2024, created a single legal standard for 27 countries—an unprecedented achievement in global digital asset policy.

Within months, the impact was visible. Compliant euro-backed stablecoins like EURC grew 2,727% year-over-year, while non-compliant assets such as USDT lost dominance. Banks, fintech firms, and custodians that had once held back began offering crypto products within a regulated environment.

MiCA turned regulation into a design principle. Instead of stifling innovation, it built the foundation for it. Europe didn’t try to catch up with crypto—it created the rulebook others now follow.

Brazil: Oversight That Unlocks Utility

In Latin America, Brazil (#5) has emerged as one of the most sophisticated regulatory environments for crypto. Its Virtual Assets Law (BVAL) placed the market under the Central Bank’s supervision, aligning it with the same compliance standards used in the traditional financial sector.

The result has been transformative. Brazil’s crypto transaction value surged 109% year-over-year, and 90% of all flows now involve stablecoins, which are increasingly used for remittances, salaries, and merchant payments.

In a country where inflation remains a defining feature of economic life, crypto has moved from speculation to practical finance—not as a protest against the system, but as a tool integrated within it. Regulation made that possible by giving citizens and institutions a reason to trust it.

Indonesia: Predictability at Scale

Among emerging markets, Indonesia (#7) represents one of the most carefully managed transitions toward regulatory maturity. For years, crypto was treated as a commodity under BAPPEBTI, the Commodity Futures Trading Regulatory Agency. This classification provided early structure—exchanges needed licenses, tokens were whitelisted, and custodians had to operate locally.

That initial discipline laid the groundwork for the next phase. Through the Financial Sector Development Law (UU PPSK), oversight has now shifted to OJK, Indonesia’s Financial Services Authority. This change moves crypto from the realm of commodities to that of financial instruments bringing it under the same umbrella as banking, fintech, and capital markets.

Indonesia’s regulatory clarity is supported by an automated crypto tax system (0.11% VAT and 0.1% income tax) and plans for OJK-led VASP licensing by 2026. With 18 million registered users, it is now one of the world’s most active yet compliant crypto markets.

Unlike many emerging economies that still swing between enthusiasm and hesitation, Indonesia has built something rare: predictability at scale.

When Rules Are Missing, Growth Stalls

In countries where regulation remains inconsistent, adoption continues, but without direction. Turkey (#14), for instance, remains one of the largest markets by volume, but shifting KYC and margin trading policies have pushed users toward short-term speculation and offshore platforms.

Iran, which operates outside global compliance frameworks, saw transaction volumes rise 11.8% year-over-year, but remains isolated from the broader financial system. In both cases, liquidity exists, but without trust, it becomes circular. The lesson is clear: markets can survive without regulation, but they can’t grow without it.

Regulation as the New Infrastructure

Behind every high-performing crypto market lies a legal foundation that supports it. Regulation doesn’t just set limits—it builds the rails on which digital assets move safely and at scale.

- Across the leading markets, three structural pillars consistently emerge:

- Licensing pathways, which define who can operate and ensure accountability;

- Defined taxation, which integrates crypto into the national economy; and

- Institutional access, which bridges digital assets with traditional banking and investment systems.

When these elements align, crypto stops existing in parallel to the financial system and becomes part of its architecture. That’s the real story of 2025: the world’s most regulated markets are no longer reacting to crypt, they’re building their economies around it.

Conclusions

Nine of the world’s top ten crypto markets now operate under clear or developing regulatory regimes. India (#1) balances retail participation with institutional access, the United States (#2) anchors global liquidity, Brazil (#5) shows how regulation enables stablecoin payments at scale, and Indonesia (#7) proves that even emerging markets can lead when the rules are clear.

Across these markets, the pattern is consistent: clarity builds confidence, confidence attracts capital, and capital drives adoption. In the next phase of Web3, success won’t come from speed, but from building with certainty. The future of crypto will be written not in whitepapers, but in policy frameworks and the nations that design them with foresight will define the next era of digital finance.

Nowhere is this transition more visible than in Indonesia, where regulation is evolving from restriction to enablement. As oversight moves under OJK and crypto taxation becomes fully integrated, the country is shaping one of the most predictable and scalable frameworks in Asia.

For global Web3 companies, that clarity is creating something rare: a market large enough to matter and regulated enough to trust.

At Indonesia Crypto Network (ICN), we help exchanges, fintechs, and blockchain projects navigate this landscape through market-entry strategy, compliance mapping, and localized execution, connecting global innovation with Indonesia’s regulated growth story.