Indonesia continues to demonstrate its growing importance in the global crypto landscape. In the newly released Global Crypto Adoption Index 2025 by Chainalysis, the country is ranked 7th worldwide, maintaining its position among the top 10 crypto adopters globally.

Although the ranking represents a shift from 3rd place last year, the move should not be mistaken for a decline in adoption. Instead, the change reflects an update in how Chainalysis measures adoption, one that now places greater weight on institutional activity rather than purely retail and decentralized finance (DeFi) engagement. For Indonesia, this underscores not weakness, but the unique strength of its grassroots-driven market.

Read more: Indonesia Tokenizes; 4 Indonesian State owned Institutions Push Real-World Assets On-Chain

A New Way of Measuring Adoption

Chainalysis’ annual index has become a trusted barometer of crypto adoption across the world. But this year, the methodology behind the ranking changed significantly. Previously, one of the key indicators was the Retail DeFi value received ranking, which highlighted countries where everyday users were actively participating in decentralized financial applications.

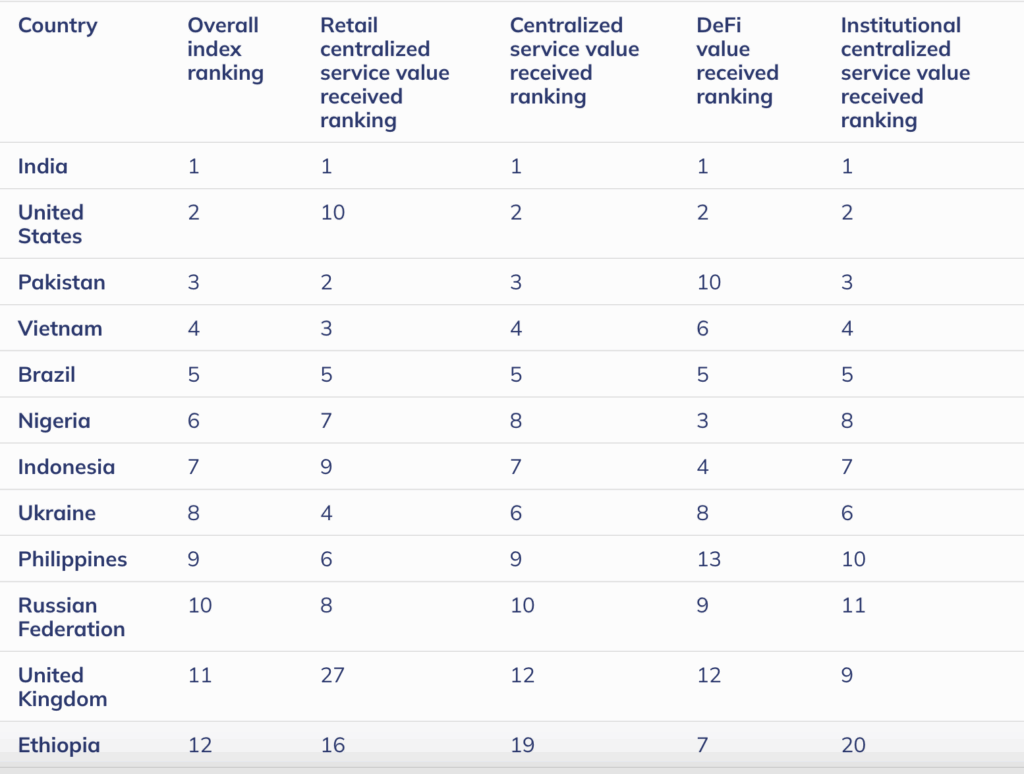

In the 2025 index, this metric was removed. In its place, Chainalysis introduced the Institutional centralized service value received ranking, a measure of high-value transactions — typically over US$1 million — conducted through centralized exchanges.

This methodological shift naturally benefits countries like the United States, where institutional trading volume is massive, and repositions markets such as Indonesia, which have historically excelled at retail and DeFi adoption.

Read more: Indonesia Ranks 3rd in Global Crypto Adoption 2024

Indonesia’s Grassroots Power

Despite this reshuffling of the metrics, Indonesia remains a crypto heavyweight in its own right. The country’s retail adoption is among the strongest in the world, with millions of individuals participating in trading, investing, and experimenting with digital assets.

The DeFi sector in particular continues to flourish. Indonesian users are not only buying and selling tokens but also engaging in staking, lending, farming, and decentralized trading. This paints a picture of a community that is both curious and innovative, unafraid to test new models of financial participation.

In many ways, Indonesia’s crypto adoption story is unique: it is not driven solely by institutions or high-net-worth individuals, but by the collective participation of everyday users. That bottom-up adoption is what makes the country’s crypto landscape vibrant and resilient.

The Road Ahead: Balancing Retail and Institutional Growth

The 2025 index serves as a reminder that while retail adoption has been Indonesia’s greatest strength, the next phase of growth may require a stronger balance with institutional activity. For that to happen, several developments will be key.

Regulatory clarity will be essential. Clearer rules and licensing for institutions will encourage larger players to participate in Indonesia’s crypto ecosystem. The introduction of new products such as ETFs or institutional-grade custody solutions could also help bridge the gap between retail enthusiasm and institutional adoption.

At the same time, exchanges, custodians, wallets, and other service providers will need to scale up to handle more sophisticated use cases. Finally, with millions of retail users already active, investor protection and education will be critical to ensure that adoption continues sustainably.

Read more: Crypto Adoption in Indonesia: Key Behavioral Drivers

A Strong Position in a Changing Landscape

Indonesia’s place in the global top 10 for crypto adoption is no small feat. This ranking reflects more than numbers — it shows Indonesia’s strength as a retail-driven powerhouse shaping digital asset use in emerging markets.

As the crypto ecosystem matures, institutional participation will grow in importance. Indonesia’s challenge is to pair its strong grassroots base with greater institutional involvement. Doing so could push the country even higher in the rankings and solidify its status as a leading crypto market.

For global businesses, this means opportunity: millions of engaged users, a vibrant DeFi culture, and a market eager for innovation. ICN helps projects and companies navigate this landscape — from partnerships and regulations to connecting with the right communities.

Ready to tap into Indonesia’s growing crypto economy? Start growing your bussiness with ICN.