Cited from a report by Indonesia Blockchain Association (ABI), crypto transaction volume in Indonesia experienced a steep decline of 61.03% throughout 2022 as the crypto market entered a bear trend. However, opposite to volume, an increase in the number of crypto traders is seen still in Indonesia, amounting to 16.3 million users as of the end of 2022, compared to only 12 million in February 2021. This indicates that adoption is still happening despite the price movements.

Seeing the positive growth of crypto adoption in Indonesia, Coinvestasi brings an exclusive event to give the latest insight and spark discussion on the crypto market and how it will transcend in 2023. The event, which was sponsored by Indodax—the first prominent crypto exchange in Indonesia, was attended by more than a hundred high-level participants from various industries; 29% of attendees came from crypto exchanges, 22% from Web3 projects, 15% from investment firms and mature traders, 9% from venture capitals.

The 2 hour-long event was packed with a panel discussion and fundamental talks & technical analysis on Bitcoin, Ethereum, and Altcoins. Welcomed by a keynote speech from Amazon Web Service (AWS) Ian Holtz on Global Web3 Trends, followed by a panel discussion on Indonesia’s industry trend in 2023 with Heriyanto Irawan (PT Verdhana Sekuritas Indonesia), Asih Karnengsih (Indonesia Blockchain Association), Markus Liman Rahardja (BRI Ventures), and moderated by Glenn Ardi (CoinDesk Indonesia). According to the panelists, here are some key takeaways of the 2023 industry trends to consider before entering the Indonesian market,

Increase of Web3 Adoptions will Take Over the Global Market

Ian Holtz opened the event with a short talk on global Web3 trends globally. With global market conditions pointing at a global recession, industry players should expect an increase in market volatility. Another reason behind Web3 adoption is The European Parliament passing the regulation on markets in crypto-assets (MiCA) which will increase regulations from government bodies. With the government bodies acting from the regulatory side and large institutions taking interest in blockchain, especially DeFi sector, Web3 players should expect an increase in Web3 adoption despite market conditions.

Rupiah will be Relatively Stable Compared to Other Countries’ Currencies

According to Heriyanto Irawan, Managing Partner of Verdhana Sekuritas Indonesia—a Securities Company and one of the members of the Indonesian Stock Exchange, currently there is a large movement on economic transformation conducted by the Indonesian government which is adding the process of manufacturing to Indonesia’s natural resources.This movement plays an important role as Indonesia will be able to produce its own natural materials and not only act as a provider to foreign manufacturers. With Indonesia taking the role deeper, this could lead to Indonesian Rupiah being relatively stable during the global economic recession.

Government Bodies are Speeding Up on Blockchain Implementations

Currently there are 5 ministries in the research & development stage to implement blockchain on their system according to Asih Karnengsih, Chairwoman of Indonesia Blockchain Association. Another progress could be found in the G20, an important event for Indonesia and many other countries in 2022. During the event, there was a special session discussing the importance of innovating the CBDC implementation on a national and global scale.

New Bill on Crypto Assets will be Administered under Financial Services Authority (OJK)

In 2018, crypto was regulated under Commodity Futures Trading Regulatory Agency (BAPPEBTI) as trading assets. The current update on crypto regulation, according to Law of the Republic of Indonesia No. 4 of 2023 on Development and Strengthening of the Financial Sector, crypto regulations will be administered directly under Financial Services Authority (OJK). This transition could lead to many opportunities for crypto projects in Indonesia.

“With the ratification of this bill, financial technology [in Indonesia] will face a new wave.”

– Markus Liman Rahardja, CIO of BRI Ventures

Strong Personnel Behind a Project is Favorable for VCs

As the Chief Investment Officer of BRI Ventures, Markus Liman Rahardja mentioned how during the bear market it is the best time to build your company and conquer the industry you want to conquer. Markus gave his perspective on how funding companies are no longer looking at how a project can last for a long time but more at the people behind the project. The integrity and honesty of the people behind the project and how they handle challenging situations matter the most for funding companies.

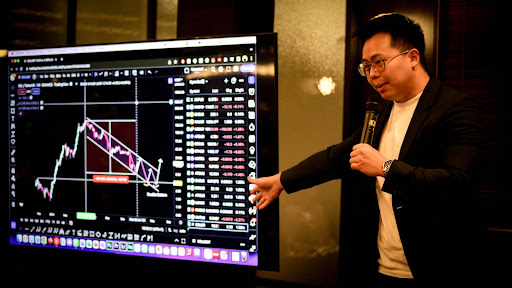

Later on, the stage was followed by fundamental and technical analysis sessions of the top 10 crypto market cap—Bitcoin, Ethereum, Altcoins, by Naufal Alvira (Indodax), Patria Abditiar (Risedle), Andri Ngaserin and Deidy Wijaya (M300), Aditya Suseno (Bitwyre), and Andy Senjaya (Crypto Trader & Influencer). The event ended with a networking session between attendees, connecting key industry players with mature traders from Indonesia.

Registered attendants came not only from local companies but also from key global players. Attending companies are Indodax, AWS (Amazon Web Services), Maybank Security Indonesia, MDI Ventures, Tezos APAC, Upbit, Emurgo, and many more. Based on their position in their respective companies, 52% of attendees are founders, C-level executives, or company executives—CEO, CIO, or CFO.

In summary, with rapidly growing blockchain companies, a large population, and government bodies that embrace the idea of blockchain technology, Indonesia presents a significant opportunity for companies looking to expand their reach in the Southeast Asian region. Indonesia Crypto Network (ICN), the parent company of Coinvestasi and CoinDesk Indonesia, is ready to support your business to the next level in Indonesia.