Indonesia’s crypto scene is buzzing with activity as we enter 2025. With its dynamic growth, regulatory shifts, and expanding blockchain ecosystem, the nation is cementing its position as a global leader in crypto adoption. Here’s your professional snapshot of where Indonesia’s crypto market stands today and what makes it a hub of opportunity.

Unmatched Crypto Adoption

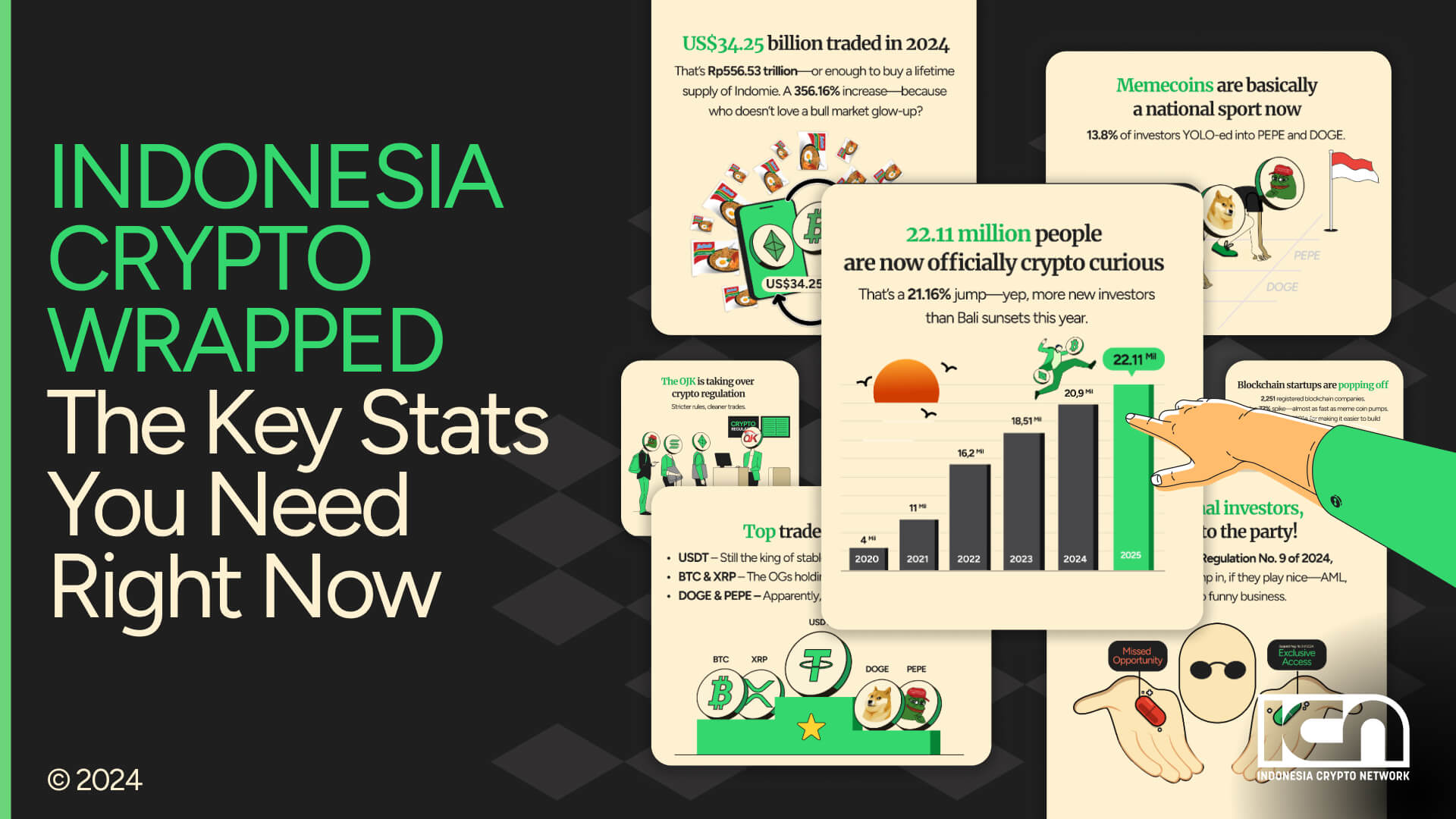

Indonesia is now the third-largest crypto adoption market globally, with over 22.11 million investors as of November 2024. This represents a 21.16% increase compared to the previous year, highlighting strong grassroots interest in crypto as a viable investment avenue.

Surging Market Transactions

The total value of crypto transactions in Indonesia hit $34.25 billion (Rp556.53 trillion) in 2024—a staggering 356.16% year-on-year growth. This unprecedented surge underscores Indonesia’s robust engagement with digital assets, from trading to long-term investment.

Crypto Trends that Define the Market

- Top Traded Cryptos:

- USDT remains the go-to stablecoin for seamless transactions.

- BTC & XRP maintain their status as market favorites.

- DOGE & PEPE prove that meme coins are more than just a trend—they’re a culture.

- Meme Coins on the Rise:

13.8% of investors are diving into meme coins, showcasing their increasing appeal as speculative assets and a fun entry point for new investors.

Read more: Blockchain Technology in Indonesia

Institutional Investors Enter the Fold

Regulations in 2024, particularly Bappebti Regulation No. 9, have opened Indonesia’s crypto market to institutional players. Companies can now invest in digital assets, provided they meet strict compliance requirements. This inclusion is expected to bring increased liquidity and professionalism to the market.

A Booming Blockchain Startup Scene

With 2,251 registered blockchain companies by the end of 2024—a 72% growth over the previous year—Indonesia’s blockchain ecosystem is flourishing. This boom is driven by KBLI 62014, a business classification that simplifies licensing and supports innovation in blockchain projects.

Regulation Takes Center Stage

The transition of crypto oversight to the Financial Services Authority (OJK) began in January 2025. OJK’s focus on stricter compliance, innovation hubs, and regulatory sandboxes sets the stage for a more transparent and robust ecosystem, ensuring a balance between growth and security.

Read more: Indonesia Expands Crypto Asset List & Transfers Regulations to OJK

What This Means for Businesses and Investors

Indonesia isn’t just a crypto market; it’s an evolving ecosystem of opportunities. With strong adoption rates, expanding blockchain applications, and supportive regulatory frameworks, this is the ideal time to tap into one of Southeast Asia’s most dynamic markets.

Partner with ICN to Succeed in Indonesia

At Indonesia Crypto Network (ICN), we specialize in navigating the complexities of the Indonesian crypto landscape. From regulatory compliance to market entry strategies, we’re here to help you thrive in this vibrant ecosystem.

📌 Explore more at indonesiacrypto.network or connect with us to take your first step into Indonesia’s crypto frontier.