In a year marked by renewed momentum in the global crypto market, Indonesia has emerged as one of the most dynamic players—not just in trading volume or hype, but in how its population is actively integrating digital assets into daily financial habits.

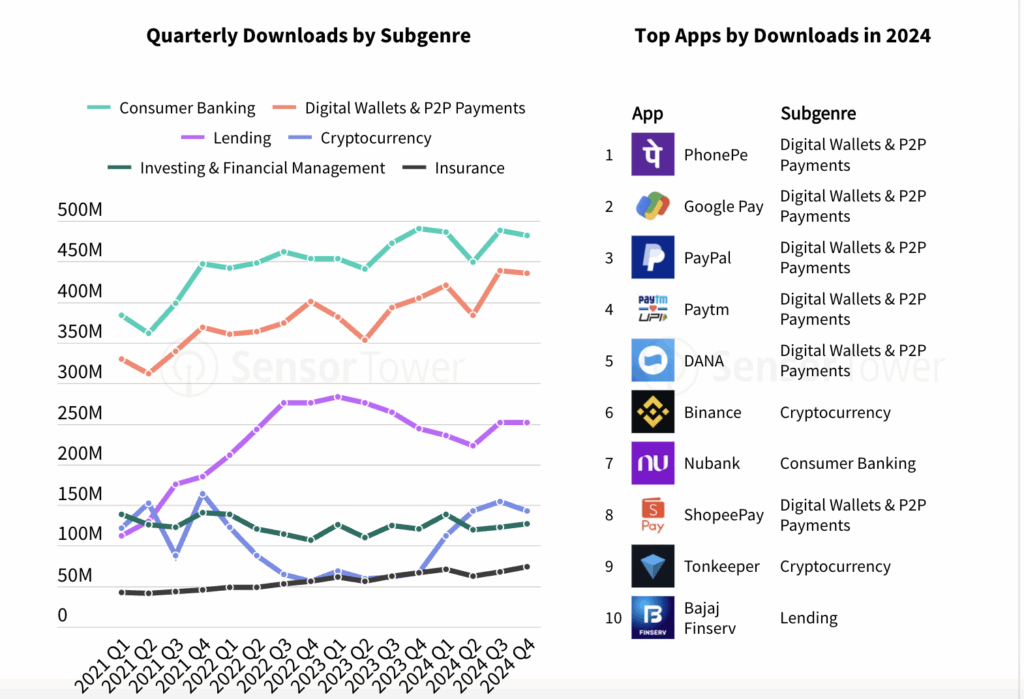

According to the State of Mobile 2025 report by analytics firm Sensor Tower, Indonesia recorded the second-highest growth in crypto app sessions globally, with a 54% year-over-year increase in 2024. This places the country just behind Germany (91%) and ahead of Brazil and France (both at 47%).

At a glance, the data reflects rising engagement. But a closer look reveals something deeper: Indonesians aren’t just trying out crypto—they’re coming back to it regularly and purposefully. That frequency of use suggests not experimentation, but integration.

A Closer Look at the Data: Engagement Over Downloads

Unlike download metrics, Sensor Tower’s session-based data measures how frequently users open and interact with apps—offering a clearer picture of actual behavior. A 54% jump in sessions means crypto apps are being used more often, not just installed and forgotten.

This trend reflects global patterns. In 2024, crypto app sessions worldwide rose by 37%, with a sharp spike in Q4 as Bitcoin prices rebounded. But Indonesia outpaced the global average, signaling that local adoption is driven by more than just market cycles. It suggests growing trust, familiarity, and long-term interest in crypto as a financial tool.

Digital Readiness Meets Financial Transformation

Indonesia’s demographics make it especially primed for mobile-first finance. With over 200 million internet users—most accessing the web through smartphones—mobile apps have become the default tool for managing money. With a median age under 30, Gen Z and Millennials are at the forefront of this shift.

Crypto fits naturally into this environment, particularly in regions underserved by traditional financial institutions. In areas where access to credit or savings products remains limited, crypto presents an alternative—though one that still requires education and responsible onboarding.

From Curiosity to Confidence: A Shift in User Mindset

According to Calvin Kizana, CEO of Tokocrypto, the data reflects more than just rising interest—it marks a shift in how Indonesians view crypto.

“The 54 percent growth in crypto app users in Indonesia is a positive signal that people are becoming more comfortable and enthusiastic about engaging with crypto assets,” said Calvin in a statement on Friday, May 30.

He also pointed to rising user maturity.

“Many users are beginning to see crypto not just as a speculative instrument, but as part of their long-term financial strategy. They are more aware of the risks, more selective in choosing platforms, and showing strong interest in education and security,” he added.

This behavior is shaping what users now expect from platforms. Accessibility alone is no longer enough. Trust, transparency, and educational support are fast becoming the key differentiators.

On-the-Ground Adoption: Beyond the Screen

While app sessions are a strong signal, much of Indonesia’s crypto growth still happens offline. Community meetups, university roadshows, creator-led workshops, and peer education all play crucial roles in building trust—especially outside major metros.

For many Indonesians, particularly in smaller cities, trust travels through social channels: friends, Telegram groups, TikTok explainers, and local Web3 events. Platforms that tap into this offline-to-online dynamic are far better positioned to earn lasting credibility.

At Indonesia Crypto Network (ICN), we’ve seen this firsthand. Through our media platform Coinvestasi, we actively support community leaders in more than a dozen cities—helping them organize discussions, distribute educational resources, and guide first-time users in navigating the crypto space safely and confidently.

What the Growth Means for Industry Players

For crypto companies eyeing Southeast Asia, Indonesia is no longer a “developing” opportunity—it’s a maturing, highly competitive market. The user base is large, active, and increasingly discerning.

This means go-to-market strategies must evolve. A basic product launch with Bahasa localization is no longer enough. Today’s users expect:

- High-quality UX,

- Accessible customer support,

- Platform integrity,

- Value beyond token incentives.

Regulation matters. Partnerships matter. Cultural and local relevance matter even more.

For international projects looking to scale in Indonesia, local insight and strategic collaboration are no longer optional—they’re mission-critical. Without them, even well-funded platforms risk being overlooked in favor of those embedded in the community fabric.

Ready to Grow in Indonesia?

Indonesia’s #2 ranking in global crypto app usage reflects not just rapid growth—but real momentum. The country’s crypto economy is evolving from one driven by curiosity to one led by conviction, routine, and maturity.

At ICN, we help Web3 projects enter and thrive in this environment—from compliance and education to strategy and adoption. If you’re serious about scaling in Southeast Asia’s most exciting crypto market, start growing with ICN.