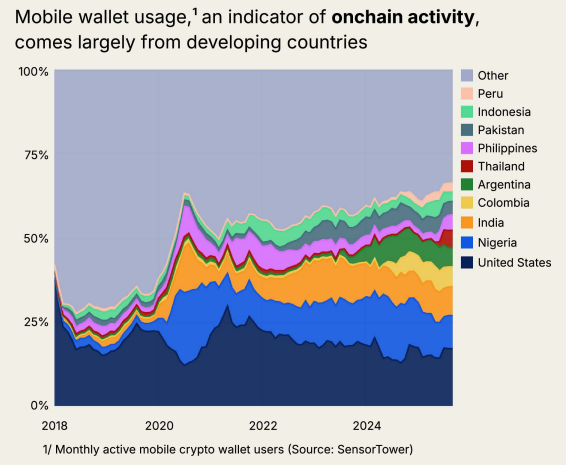

According to a16zcrypto’s State of Crypto 2025 report, Indonesia now ranks second in the world for active mobile crypto wallet users, just behind Peru and ahead of Pakistan. This marks a major shift in global crypto adoption. While countries like the United States and Germany still dominate web traffic related to crypto, emerging markets are now driving real on-chain activity and Indonesia is at the forefront.

A Digital Nation Ready for Web3

Indonesia’s rise is no coincidence. It’s built on strong digital foundations. According to the Indonesian Internet Service Providers Association (APJII), by 2025 there were 229.4 million internet users, representing 80.66% of the population. Most Indonesians access the internet via smartphones, creating a mobile-first culture that perfectly aligns with crypto wallet adoption.

The success of e-wallets such as GoPay, OVO, and DANA paved the way for this transition. Millions of Indonesians are already comfortable with digital payments, QR codes, and instant transfers, habits that make using crypto wallets intuitive and frictionless.

Regulation has also evolved. While crypto is not a legal payment instrument, it is recognized and regulated as a digital asset class under Indonesia’s Financial Services Authority (OJK). This regulatory clarity has boosted user confidence and attracted institutional interest. By early 2025, Bappebti recorded around 17 million registered crypto investors, signaling that digital assets have moved from niche communities to mainstream awareness.

Read more: Indonesia Sets a New National Standard for Crypto Accounting and Business Transparency

From Speculation to Structure

In its early phase, Indonesia’s crypto adoption was fueled by speculation — trading tokens, chasing price swings, and short-term investing. But as user literacy and infrastructure matured, the landscape began shifting toward more structured and sustainable growth.

Today, crypto in Indonesia remains largely investment-driven, yet new patterns of functional use are emerging. Remittances are becoming one of the most tangible examples, as migrant workers turn to crypto for faster and cheaper cross-border transfers. At the same time, stablecoins are gaining traction as tools for savings and hedging, allowing investors to hold USD-pegged assets to manage currency volatility.

According to the State of Crypto 2025 report by a16z (page 18), stablecoins now process over US$46 trillion in annual transactions, nearly matching Visa and PayPal in scale.

This marks a pivotal shift — crypto is evolving from a speculative asset into financial infrastructure that supports inclusion, cross-border commerce, and long-term stability.

With over 1,400 crypto assets approved for trading, Indonesia has become a regulated, opportunity-rich market where global players can expand confidently — and local innovators can build with trust.

Read more: Indonesia Expands Its List of Approved Crypto Assets to 1,421 Tokens

Global Momentum, Local Opportunity

Indonesia’s trajectory reflects the broader direction of global finance. Institutional players like BlackRock, Fidelity, and PayPal now collectively manage over US$175 billion in crypto-based ETFs, while blockchain networks such as Arbitrum, LayerZero, and Hyperliquid can process thousands of transactions per second, matching traditional payment systems in scale and speed.

These advancements in global blockchain infrastructure now make it easier for projects entering Indonesia to build on mature, battle-tested networks and tools, such as layer-2 scaling solutions, stablecoin rails, and interoperability APIs. While technical adaptation and local compliance are still essential, these global foundations significantly lower R&D costs and accelerate product development in the Indonesian market.

With a young, tech-savvy population, high smartphone penetration, and growing regulatory clarity, Indonesia is emerging as a strategic launchpad for Web3 products — from crypto wallets and DeFi applications to blockchain-powered payment solutions across Southeast Asia.

Read more: Go-to-Market Strategy for New Crypto Projects in 2026

ICN: Your Partner for Web3 Growth in Indonesia

To succeed in Indonesia’s fast-evolving Web3 market, global projects need more than translation; they need local understanding and real community connection. ICN helps crypto, fintech, and Web3 brands localize, launch, and grow from market-entry strategy and partnerships to storytelling and community activation.

With 229 million digital users, a young population, and a maturing regulatory environment, Indonesia is now one of the world’s most strategic markets for crypto adoption. Ready to grow in one of the world’s most active on-chain economies? Partner with ICN and turn visibility into traction.