Coinvestasi conducted an online crypto survey of Indonesians to learn more about the habit of investing among Indonesians specifically cryptocurrency. There were 1,086 unique respondents from December 22nd, 2023 to January 10th, 2024.

Some respondents have more than one favorite investment with Crypto assets being the most favorite (96.8%). Followed by Stock (33.7%), Gold (26.6%), Mutual Funds (13.8%), Property (11.9%), Deposit (6.4%), Bonds (5.1%), and others (2.2%)The overwhelming preference for crypto assets among Indonesians aligns with the country’s significant crypto engagement, evidenced by 18.25 million investors in November 2023. This trend, coupled with an average monthly increase of 437,900 new crypto customers, highlights the widespread adoption and growing popularity of digital assets.

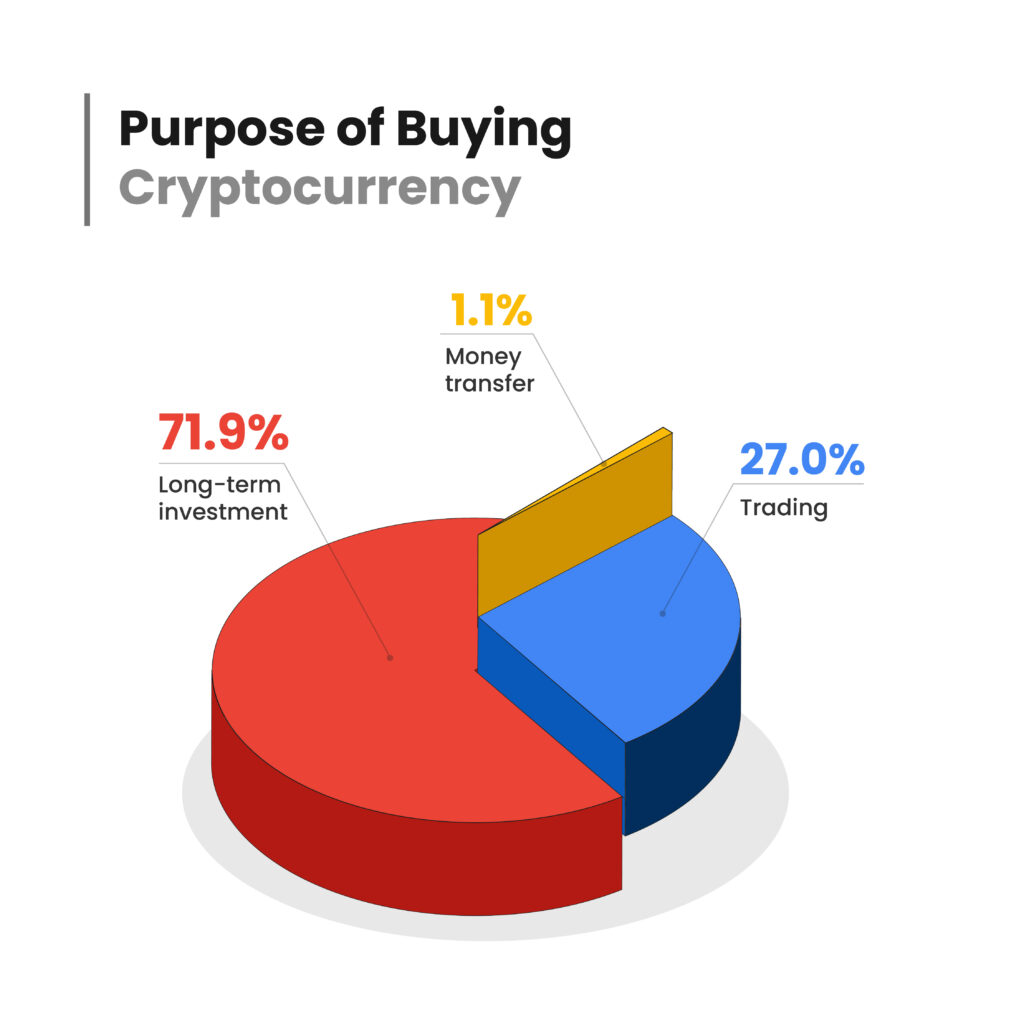

Indonesia Crypto Users are Long-Term Investors

In Indonesia, the enthusiasm for cryptocurrencies extends beyond mere speculation, with a significant portion of the population viewing them as a viable future asset class. This perspective is supported by a survey where a substantial 71.9% of Indonesian crypto users identified long-term investment as their primary reason for engaging with cryptocurrencies. This trend indicates a deep-seated belief in the enduring value and potential of digital currencies to serve as a cornerstone in the evolving landscape of financial assets.

Moreover, trading activities among Indonesian crypto users also highlight the dynamic nature of the crypto market in the country, with 27% of respondents citing trading as their main motivation. This indicates a robust engagement with the market’s volatility, where users seek to capitalize on price fluctuations to achieve short-term gains. This dual approach—balancing long-term investment with active trading—illustrates the multifaceted relationship Indonesian users have with cryptocurrencies, embracing both their potential for long-term growth and the opportunities presented by short-term market dynamics.

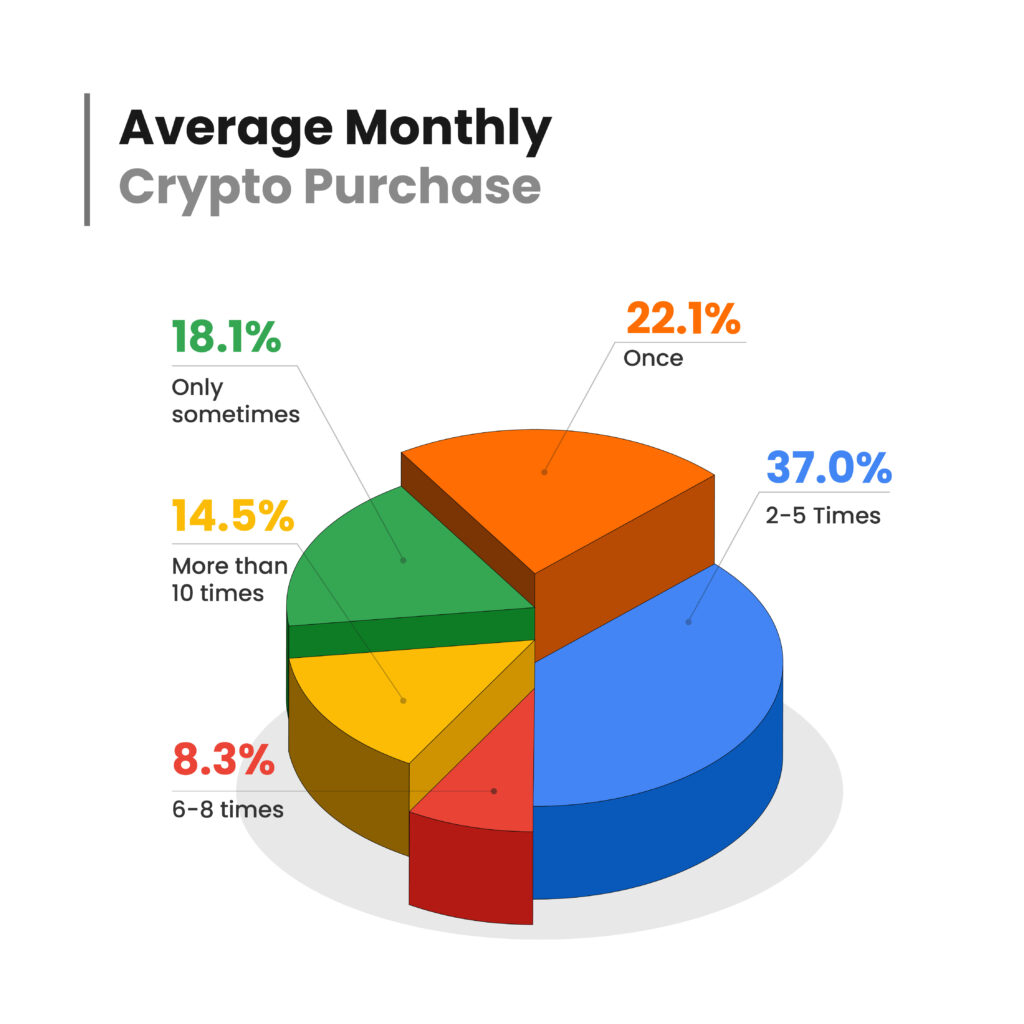

Monthly Crypto Buying Frequency in Indonesia

In Indonesia, cryptocurrency purchasing habits reveal a nuanced approach among investors, with a notable 37% engaging in the market 2 to 5 times a month. This group likely represents a mix of strategic investors actively managing their portfolios to capitalize on market trends and diversify their investments. Their activity suggests a deliberate approach, balancing between seizing market opportunities and maintaining a steady investment pace. This frequency of purchases points to a keen interest in the crypto market, driven by a belief in its long-term potential and the desire to optimize short-term gains. Meanwhile, the 14.5% who engage in buying crypto more than 10 times per month are indicative of highly active traders, deeply involved in the market’s daily fluctuations.

On the other end of the spectrum, 22.1% of respondents buy crypto once a month, indicating a more conservative investment strategy, possibly focusing on long-term growth rather than immediate returns. The diversity in buying frequencies underscores the varied investment strategies within the Indonesian crypto community, from cautious to highly speculative, reflecting the broad appeal and dynamic nature of the cryptocurrency market.

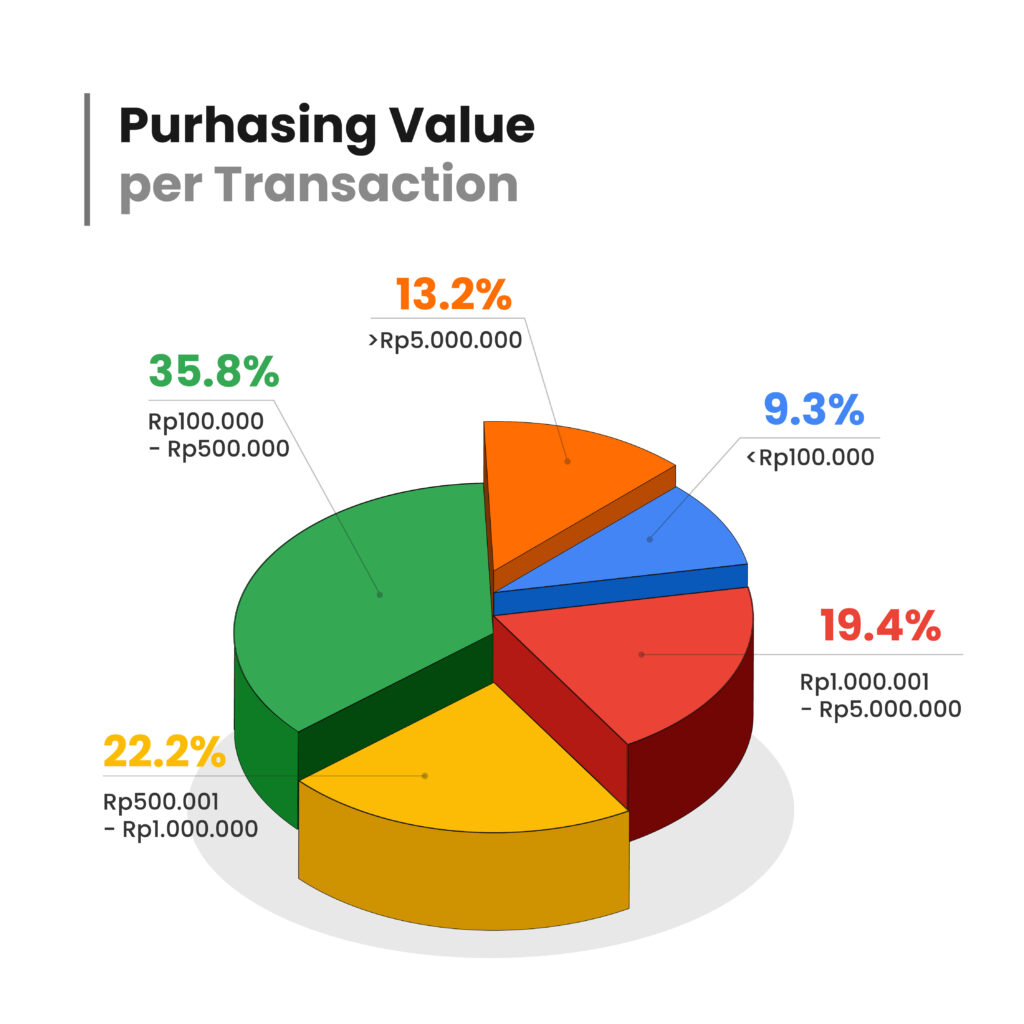

53.7% of Indonesian Crypto Users Spend More than US$35 per Buying Transaction

The average monthly minimum wage in Indonesia is relatively low compared to other countries, with only Rp3.049.743 or a little less than US$195. Considering this, the purchasing range per transaction on this survey starts as low as Rp100,000 (US$6.5) to Rp5,000,000 (US$350) or more.

The diversity in the Indonesian crypto market is further illustrated by the spending habits of its users. Nearly half of the respondents with a total of 40.7% chose the higher spending brackets of Rp500,001 to Rp1,000,000 (US$35 – US$75) and Rp1,000,001 to Rp5,000,000 (US$75 – US$350). Looking at the minimum wage in Indonesia, this reflects a segment of a higher number of heavily invested individuals.

Additionally, 13% of users spending over Rp5,000,000 (US$350) signify a smaller yet financially significant group of investors. This range in spending levels highlights the varied financial engagement and evolving understanding of cryptocurrency usage, extending beyond mere speculation to a more nuanced approach in the crypto sphere.

Whilst 35% of respondents only spend Rp100,000 to Rp500,000 (US$6.5 – US$35) per crypto transaction, indicating a significant portion engaging in crypto with moderate financial commitments. This is also the reason why the majority of local crypto exchanges have low minimum deposits starting from Rp10,000 (US$0.65) to Rp100,000 (US$6.5). This aims to lower the barrier for Indonesians to get into crypto.

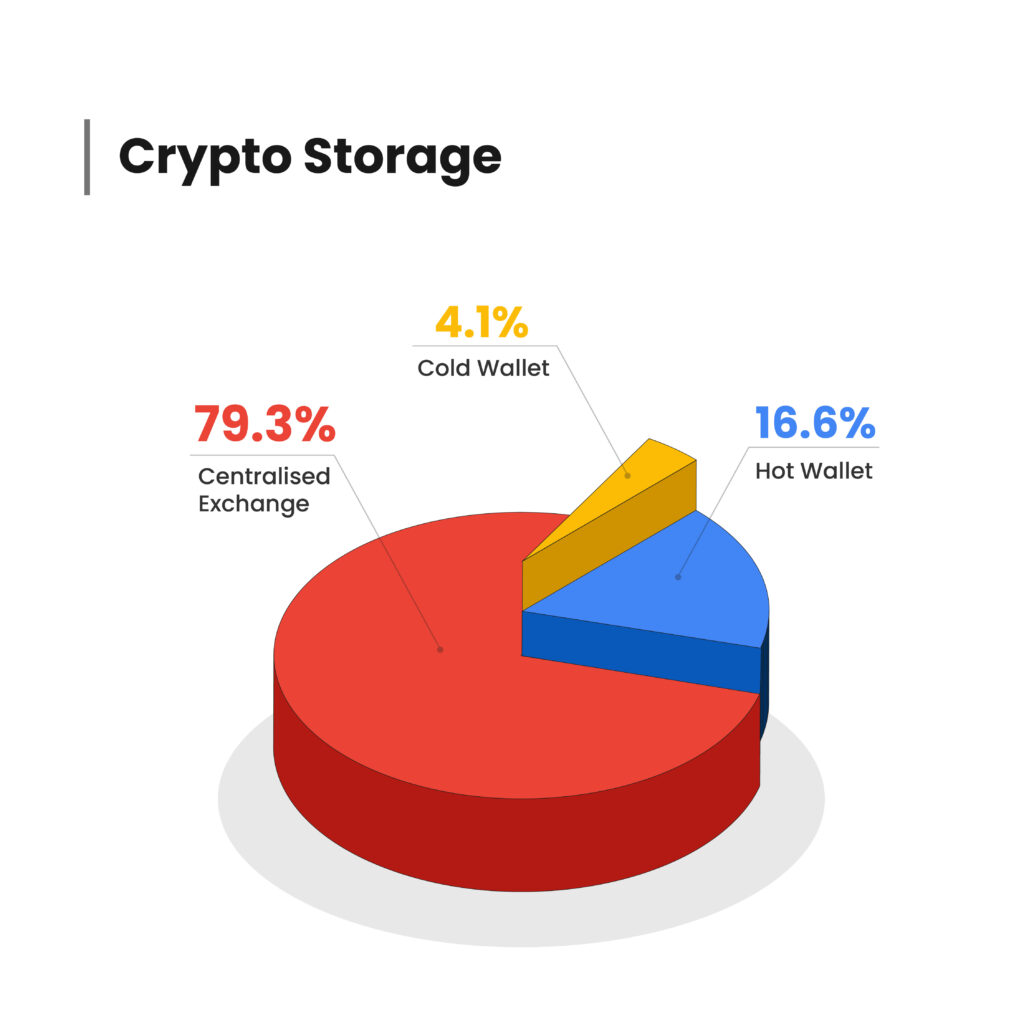

Indonesian Crypto Storage Preferences: Trust vs Security

A significant 79.3% of Indonesian crypto users opt to store their digital assets in centralized exchanges, a choice that underscores the trust and reliance on these platforms. This preference is likely influenced by several factors that make centralized exchanges appealing to a broad audience. Firstly, the ease of use offered by these platforms such as user-friendly interfaces and straightforward transaction processes lower the barrier to entry into the crypto world. Additionally, the perceived security provided by centralized exchanges, which often include layers of protection such as two-factor authentication and insurance against certain types of hacks, offers a sense of safety to users.

Despite the dominance of centralized exchanges, 16.6% of the community prefers hot wallets for their crypto storage, while 4.1% opt for cold wallets. Hot wallets, being connected to the internet, offer convenience and quick access for trading and transactions, appealing to users who prioritize flexibility and immediate access to their assets. On the other hand, the use of cold wallets, which are not connected to the internet thus offer a higher level of security against online hacking attempts.

This data shows that not many users demonstrate a proactive stance on security. The majority of Indonesian crypto investors would not accept the trade-off of centralized exchange’s convenience for the peace of mind that comes with hot and cold wallet-enhanced protection of their assets. One of the reasons is that the notion that you can lose your assets if you misplace or forget your private keys and seed phrases could be daunting. This calls for wallet providers that offer both convenience and enhanced security to lower the barrier for Indonesian crypto users.

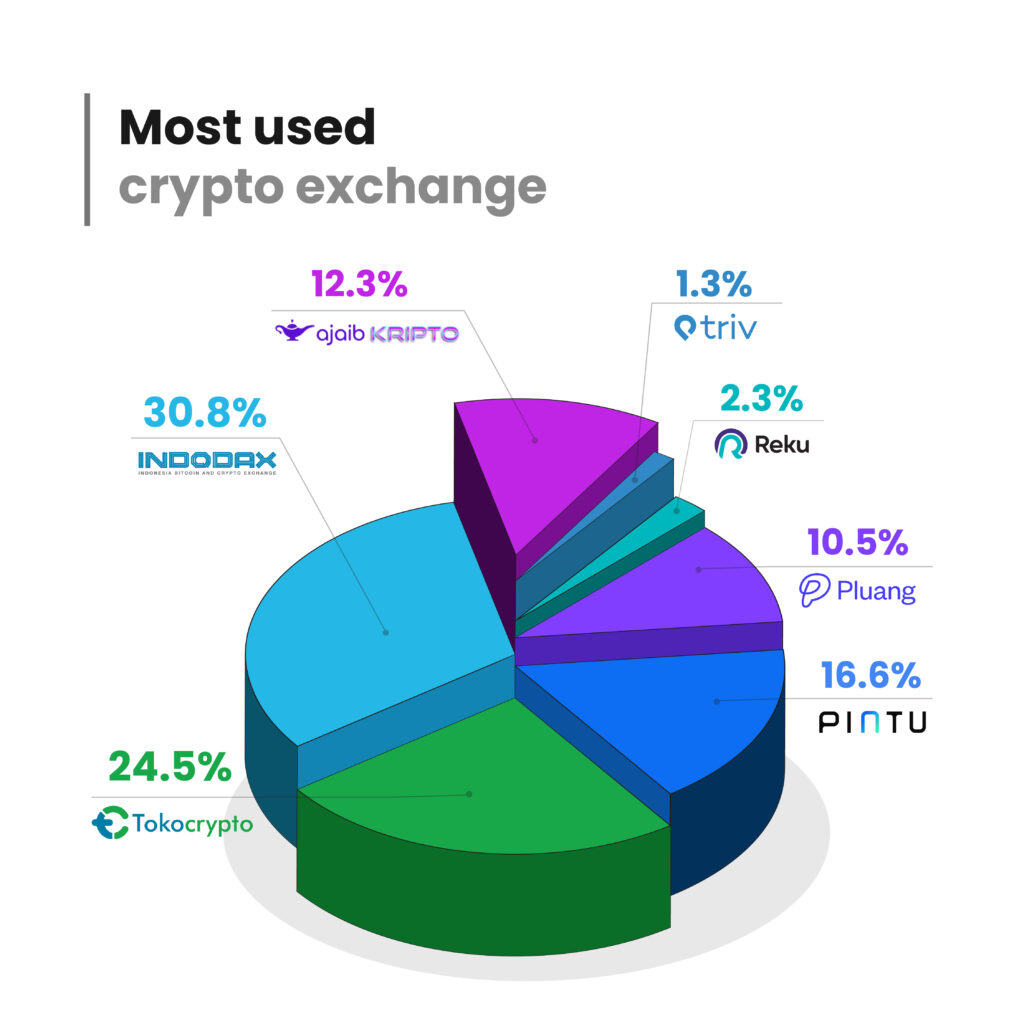

The go-to Crypto Exchanges for Indonesian Crypto Investors

Despite the prominence of global exchanges, the Indonesian crypto market also shows a strong preference for local platforms, underscoring a vibrant domestic exchange ecosystem. These local exchanges offer unique advantages, including local currency transactions, compliance with Indonesian regulations, and tailored customer service, which resonate with the preferences of Indonesian users. The popularity of these platforms reflects a balanced approach by Indonesian investors and traders, who navigate between the expansive opportunities offered by global exchanges and the localized services of domestic platforms.

For crypto users opting for local exchanges, Indodax, as the leading and the first-ever Indonesian crypto exchange, commands a substantial share of 30.8% among Indonesian crypto investors, making it the most favored choice for those who prioritize local market access and support. Following closely are Tokocrypto at 24.5%, Pintu at 16.6%, Ajaib Kripto at 12.3%, and Pluang at 10.5%.

However, according to Coinmarketcap trading volume data, there is a significant difference in terms of position. Among Indonesian local exchanges listed on Coinmarketcap, Tokocrypto placed on the first rank by its 24-hour trading volume at US$11,026,056. Followed by Indodax in second place with US$9,264,410 trading volume and Reku in the third position with US$6,171,550. Ajaib Kripto and Pluang are both relatively new compared to other Top 5 exchanges. Ajaib and Pluang started as an app for stock investing. Having them in the top 5 positions could be the product of their stock investor user base starting to use the app for crypto investing.

Conclusion

The insights from our survey paint a comprehensive picture of the Indonesian cryptocurrency landscape, from investment habits to platform preferences and storage solutions. It is evident that Indonesians are deeply engaged with the digital asset market.

For businesses seeking to expand their presence in the Indonesian crypto market, ICN offers invaluable marketing and promotional services tailored to the crypto and blockchain industry. By partnering with ICN, you can leverage our expertise, access a network of industry professionals, and tap into the vast opportunities within Indonesia’s thriving crypto ecosystem.