Indonesia’s crypto ecosystem has expanded rapidly over the past six years, but the reasons behind this growth run deeper than large transaction numbers or rising user counts.

When we look at the data from 2019 to 2025, a clearer picture forms: Indonesia’s rise is driven by structural changes in society, technology, financial behaviour, and regulation. Together, these shifts create an environment where crypto adoption can grow steadily, even when global markets fluctuate.

Below are five interconnected factors that explain why Indonesia has become one of the world’s most dynamic crypto markets.

A Growing Investor Base That Expands Even When Markets Slow Down

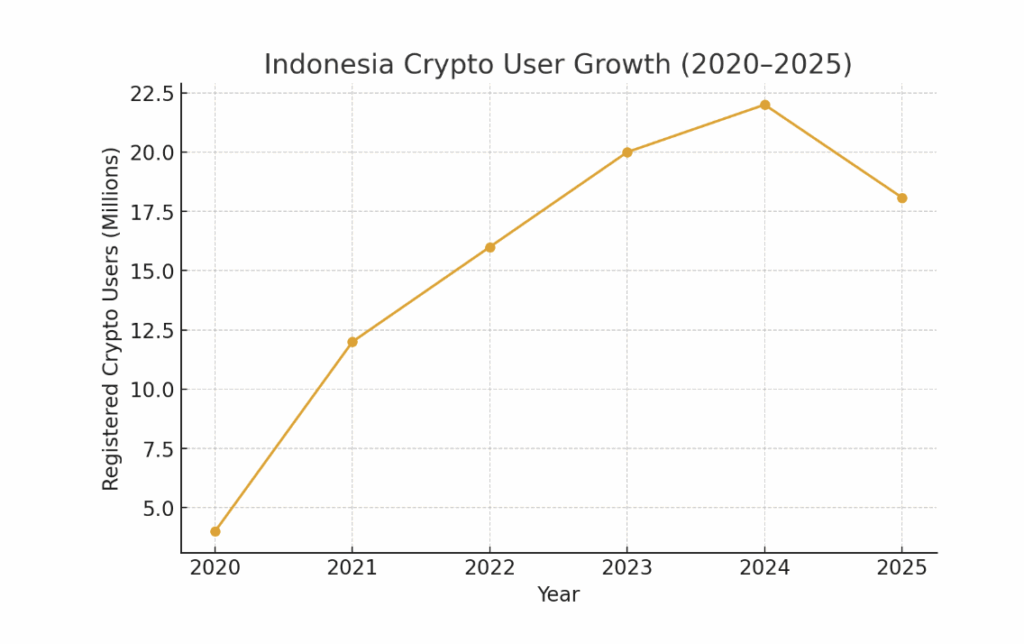

One of the most telling indicators of Indonesia’s momentum is the steady rise in the number of people participating in crypto. In 2020, the country recorded about four million registered investors.

That number nearly tripled in 2021 and continued climbing to more than sixteen million in 2022. Adoption did not taper off during market corrections, instead, it grew to twenty million in 2023 and over twenty-two million by late 2024.

By 2025, the reporting method changed under OJK’s data standard, capturing 18.08 million crypto consumers as of August 2025. While the figure appears different, the underlying trend remains consistent: Indonesians continue entering the ecosystem each year. This consistent participation forms the base of a durable market, not one driven only by short-term cycles.

Read more: Indonesia Secures Its Spot in the Global Top 10 for Crypto Adoption in 2025

Transaction Volumes That Reflect Real, Not Superficial, Activity

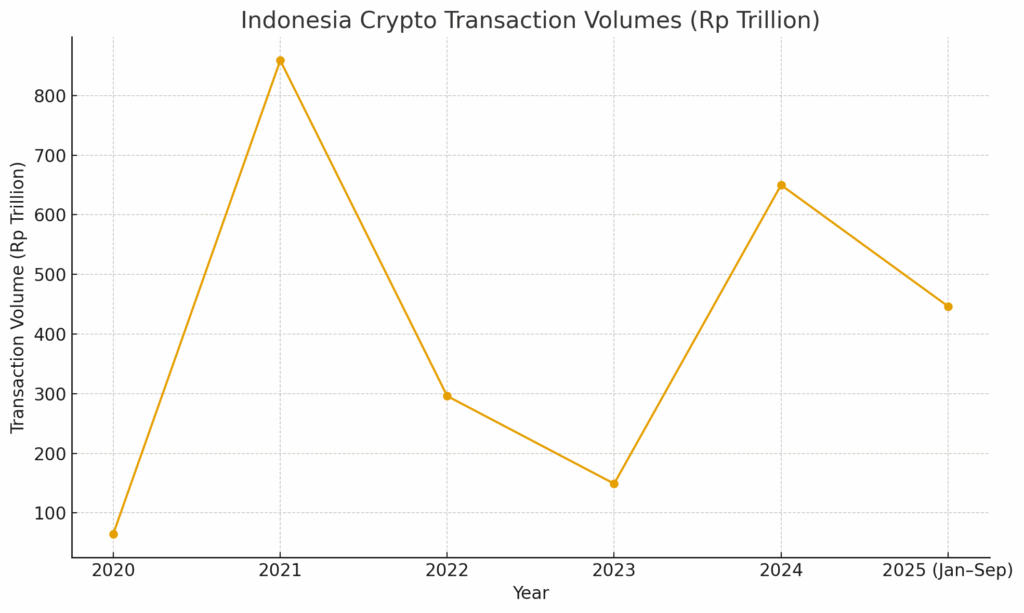

The strength of a crypto market isn’t defined by sign-ups but by real trading activity — and Indonesia’s numbers show solid engagement across cycles. Transaction volumes rose from Rp64.9 trillion (~USD 3.9B) in 2020 to Rp859 trillion (~USD 52.1B) in 2021 at the peak of retail enthusiasm, before correcting to Rp296 trillion (~USD 17.9B) in 2022.

Activity eased further to around Rp149 trillion (~USD 9.1B) in 2023 as investors adjusted to the bear market and new regulations, yet trading remained. Momentum returned in 2024, surpassing Rp650 trillion (~USD 39.4B). By September 2025, total transactions reached Rp446.55 trillion (~USD 27.1B), with natural monthly fluctuations.

These shifts are normal for a market that is becoming more mature. They show that Indonesians are responding to market conditions with intention, rather than trading impulsively at all times.

Read more: Indonesia’s Crypto Transactions Hit IDR 109.29 Trillion in Q1 2025

A Digital-Native Population That Embraces New Financial Tools Naturally

Indonesia’s demographic structure is one of the biggest reasons crypto adoption has taken root so quickly. With more than 280 million people and a median age of around thirty, Indonesia has a population that is young, digitally literate, and accustomed to managing money on mobile devices.

E-wallets, QRIS payments, and digital banking services already dominate everyday transactions. Within this digital environment, crypto is not perceived as a strange or unfamiliar asset class. It fits into the existing rhythm of how Indonesians send, store, and interact with money.

Because of this, crypto adoption grows organically. It doesn’t require large educational leaps or major behaviour changes. It simply builds on habits that already exist in one of the world’s most mobile-first economies.

Regulation That Gradually Introduces More Clarity and Confidence

Indonesia is recognized as one of the countries with the most adaptive and forward-moving crypto regulatory frameworks. Unlike many markets where regulations arrive late or take the form of sudden bans, Indonesia has spent several years developing a complete, end-to-end crypto infrastructure that is supervised, audited, and integrated into the broader financial system.

Read more: Indonesia’s Crypto Regulation: A Full Guide for Companies

Through the Commodity Futures Trading Regulatory Agency (Bappebti), Indonesia became the first country in the world to formalize a crypto ecosystem with a licensed national crypto bourse, a dedicated crypto clearing house, licensed crypto asset traders, and a government-approved list of tradable digital assets.

This level of structured oversight remains rare globally, and Indonesia is one of the few jurisdictions where the entire trading pipeline from the crypto bourse to the clearing house to licensed traders operates under a unified regulatory framework.

Regulation continues to mature as responsibilities gradually transition to the Financial Services Authority (Otoritas Jasa Keuangan / OJK), which now publishes routine consumer updates and prepares broader financial oversight for digital assets.

Clear rules, formal supervision, and transparent infrastructure help users trust regulated platforms while giving businesses a stable foundation for building in the country.

Read more: 4 Markets Proving That Regulation Drives Crypto Growth

User Behaviour That Is Slowly Shifting Toward Long-Term and Utility-Focused Use

The final reason Indonesia’s crypto market continues to grow is the maturity of its users. According to the ABI Report (2024), 55% of Indonesian crypto users now say they invest for the long term, while only 28% focus on active trading.

This shift towards longer horizons signals that crypto is becoming part of how Indonesians plan, save, and diversify their financial lives. The rise of staking, yield-based products, derivatives trading, and interest in assets like RWAs demonstrates that users are exploring beyond basic buying and selling.

A market shaped by long-term participation tends to be more stable. Even when monthly transaction values fluctuate, the foundation of committed users keeps overall activity strong.

Indonesia’s Growth Comes From Several Forces Moving in the Same Direction

When we connect the last six years of data, Indonesia’s rise becomes easier to understand. More people join the ecosystem every year. Transaction activity continues at substantial levels. Digital habits make new financial tools easy to adopt. Regulations are becoming more structured. And users are engaging with crypto in more thoughtful ways.

These combined factors are what make Indonesia one of the fastest-growing crypto markets in the world today not one defined by hype, but one supported by real, ongoing shifts in how people interact with digital assets.