Indonesia’s crypto asset industry showed resilience in 2023 despite global regulatory challenges and scandals. The sector is anticipated to continue its positive trajectory into 2024. According to the Commodities and Futures Trading Supervisory Agency (Bappebti), by November 2023, 18.25 million new customers had registered, engaging in transactions totaling IDR 122 trillion or equal to USD$7.7 billion.

The cryptocurrency landscape is expanding, and the country itself has seen significant growth in its crypto market, boasting 30 Registered Physical Crypto Asset Traders (CPFAK) recognized by Bappebti as exchange brokers. There are currently 501 legally tradable crypto assets in the country, reflecting the market’s dynamism and sustained appeal among the Indonesian populace.

Indonesian crypto users form a diverse demographic, with a noticeable concentration among the younger population, possibly due to a higher comfort level with technology and a greater affinity for risk-taking. Based on data from Bappebti, the demographic breakdown of crypto investors reveals that 32% fall within the 18-24 age group. Another 30% are in the 25-30 age bracket, while 16% are between 31-35 years old. The demographic profile further indicates that 79% of crypto investors are male, with females constituting 21% of the investor base.

Additionally, the recent increase in educational initiatives and crypto awareness campaigns, including events like Coinfest Asia, has significantly contributed to a more knowledgeable user base. Events like this serve as a platform for crypto enthusiasts to come together, connect, and gain insights. With speakers sharing valuable information about the industry, it also plays a role in spreading awareness and educating Indonesians about cryptocurrencies. This growing understanding has led many Indonesians to view crypto not just as an investment opportunity, but also as a tool for financial inclusion, particularly in regions with limited access to traditional banking services.

On the other hand, crypto asset trading poses significant technical and technological challenges. Exchanges, clearing institutions, depositories, and the Commodities and Futures Trading Supervisory Agency (Bappebti) play crucial roles in ensuring safe and transparent trading. Safeguarding traders and customers from fraud and money laundering risks is imperative for the government. Regulations and supervision, similar to those in traditional financial institutions, can enhance investor trust in crypto asset traders.

Centralized vs Decentralized

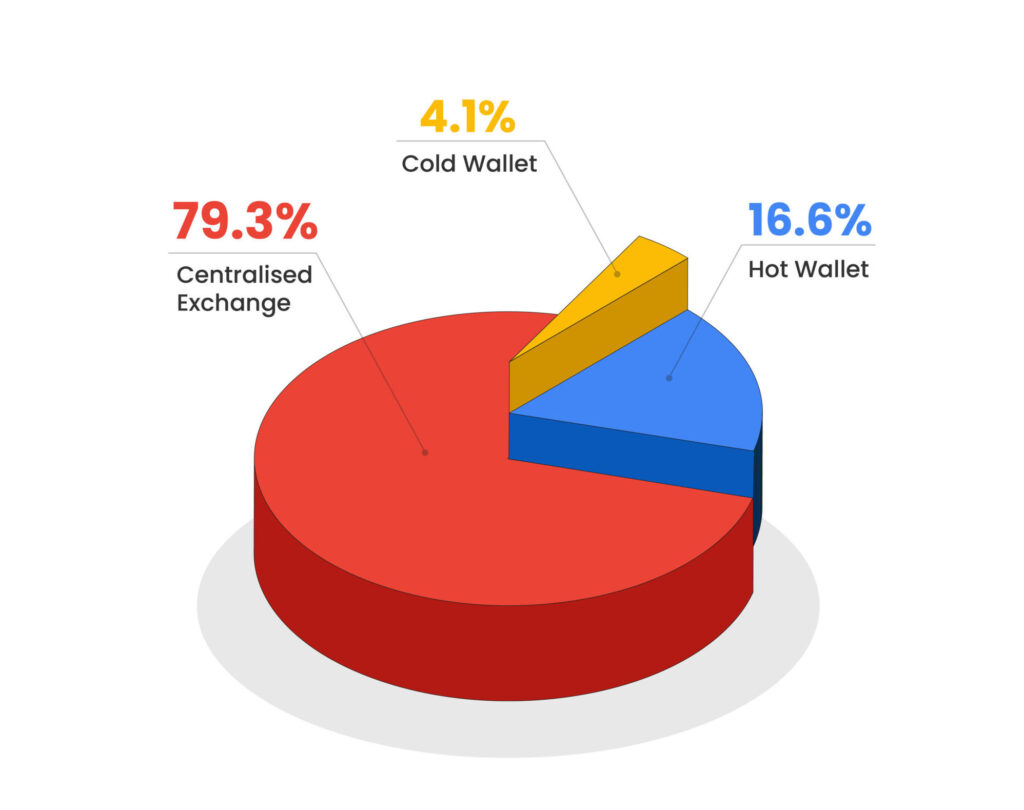

According to Coinvestasi’s survey, it was found that the majority of respondents, accounting for 79.3%, prefer using centralized exchanges to store their cryptocurrency. Only a small percentage, 16.6%, opt for hot wallets, while an even smaller fraction, 4.1%, prefer the security of cold wallets. This paints a picture of varied preferences and usage patterns in the storage and transaction methods within the surveyed group. Both custodial and non-custodial wallets each come with their own set of advantages and disadvantages concerning privacy, security, and user-friendliness.

Why Indonesian Users Prefer Centralized Exchanges as Storage

Typically, the starting point for entering the world of cryptocurrency trading is a centralized wallet, usually offered by centralized exchange (CEX) – a digital platform where crypto transactions happen. Centralized exchanges have distinct characteristics, notably holding the private keys to clients’ wallets, crucial for cryptocurrency transactions, and often require users to undergo a Know Your Customer (KYC) process. This process, aligning with regulatory standards, involves submitting identity information and verification documents, granting users account funding and trading privileges upon completion.

They offer several advantages to users, including a user-friendly interface designed for easy navigation, deposit, and withdrawal of funds. Users also often opt for custodial wallets to store their crypto assets due to the convenience and added security features they offer. Custodial wallets provide users with easy access to their assets through the platform’s account. The appeal lies in the fact that users don’t need to personally manage and remember the private key associated with their crypto wallet, reducing the risk of key loss and the inability to recover funds. They also often implement additional security layers such as password recovery and multi-factor authentication, enhancing the overall protection of users’ accounts.

However, the centralized exchanges also come with significant drawbacks. Users lack control over their crypto wallet keys, exposing them to potential losses, especially if an unregulated exchange suddenly shuts down. Security concerns are prominent, with past high-profile hacks resulting in substantial cryptocurrency losses. The centralized nature makes these exchanges susceptible to rug pulls, impacting investors.

The Indonesian government’s commitment to safeguarding customers in the cryptocurrency market is underscored through its regulation of legal crypto exchanges. These exchanges offer a crucial layer of protection against incidents such as hacking or suspicious asset disappearances. In the unfortunate event of such incidents, users on Bappebti-recognized exchanges have the legal right to pursue action, including filing lawsuits and seeking compensation for lost funds. This enhances the exchange’s credibility, signaling adherence to established standards and legitimacy for operations within Indonesia.

Conclusion

In conclusion, Indonesia’s crypto landscape has demonstrated resilience and growth amid global challenges, with a significant surge in new customers and transactions. The diverse demographic of Indonesian crypto users, particularly concentrated among the younger population, highlights the widespread appeal of digital assets. The preference for centralized exchanges among users, as revealed by Coinvestasi’s survey, underscores the convenience and user-friendly interfaces offered by such platforms. While custodial wallets on centralized exchanges provide ease of access, the drawbacks of potential security threats and loss of control over private keys are still evident. The government’s regulatory efforts, spearheaded by Bappebti, aim to protect users through legal crypto exchanges, providing a framework for accountability and legal recourse.