With an astounding 18.2 million users, Indonesia’s crypto industry is not just thriving in sheer numbers but also undergoing significant evolution in terms of regulatory and infrastructural development. The substantial growth in crypto investors, supported by a robust regulatory framework and a well-structured trading ecosystem, places Indonesia at the forefront of the global crypto market.

This article delves into the Indonesian crypto stats based on a recent report by Coinvestasi.

See and download report here:

The Rise in Crypto Investors

According to the Chainalysis Global Crypto Adoption Index, Indonesia experienced a significant growth. Moving from 20th place in 2022 to 7th in 2023, reflecting the region’s growing prominence in the crypto space.

18.25 Million Indonesian Crypto Investors

Indonesia’s engagement with cryptocurrency has seen a remarkable surge, with the number of crypto investors reaching 18.25 million as of November 2023, it grew from 16,7 million at the end of 2022.

This astonishing figure underscores the growing popularity of digital assets in the country. A key factor contributing to this trend is the average monthly increase of 437,900 new registered crypto customers, indicative of the burgeoning interest among Indonesians in the crypto market.

Java & Bali: The Crypto Hotspot

The regional distribution of crypto investors in Indonesia reveals a significant concentration in Java, accounting for 66.2% of the total crypto investors in the country. This dominance of Java & Bali in the Indonesian crypto landscape can be attributed to its status as the economic and technological hub of the country, fostering a conducive environment for crypto investments.

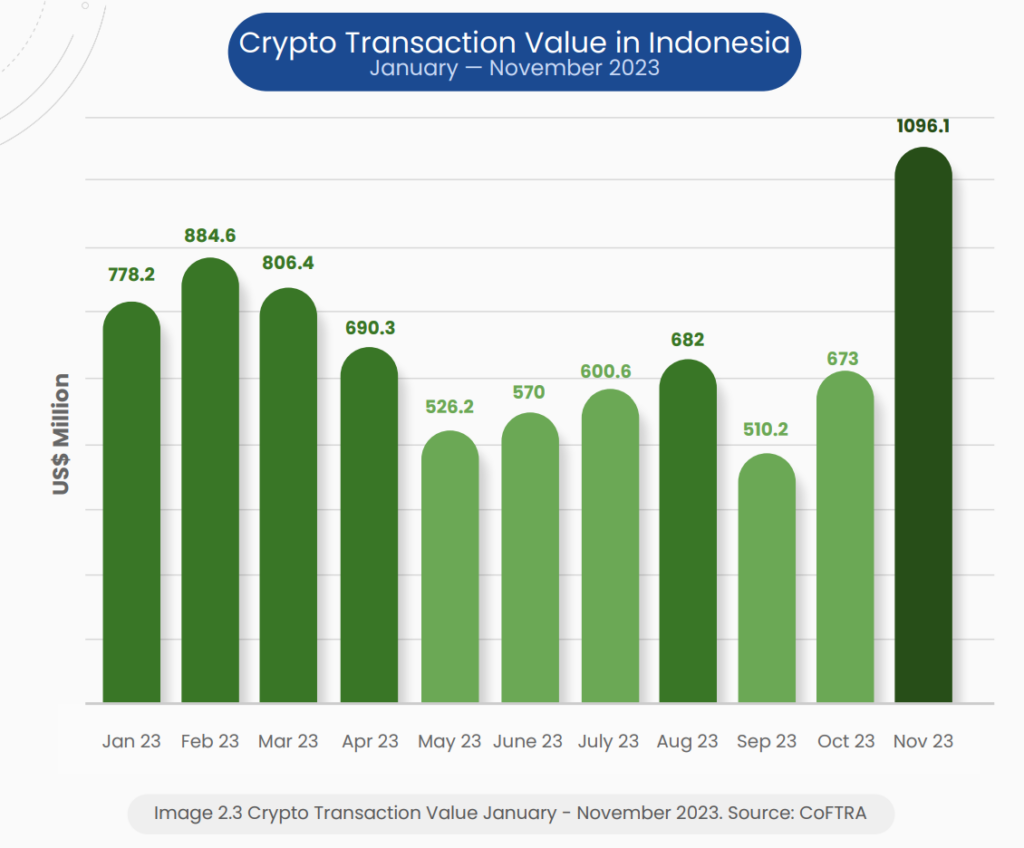

US$7.82 billion Crypto Trading Volume: Resilience in a Bear Market

In bear market conditions and fluctuating dynamics, the total transaction value or total crypto trading volume in Indonesia from January to November 2023 amounted to a substantial Rp122 trillion around US$7.82 billion. Despite a decline in the total transaction value of crypto assets in 2023 compared to US$19.6 billion in 2022 there was a notable upswing in November 2023. This resilience in Indonesia’s crypto transaction value, reflects the robustness and adaptability of the Indonesian crypto market in the face of global economic challenges.

USDT and BTC emerge as the leading crypto assets in terms of transaction value for the period spanning January to November 2023. Among the frequently featured digital assets in the top 5 rankings are SHIB, DOGE, and XRP.

Indonesia Crypto & Web3 Regulatory Landscape

Indonesia’s regulatory framework for Web3 and crypto is evolving, with the government taking a proactive stance. There are detailed guidelines for various aspects of the industry, including transaction monitoring, anti-money laundering measures, and guidelines for crypto asset trading.

The Indonesian crypto market operates under a regulatory framework primarily governed by CoFTRA Regulation Number 13 of 2022 and CoFTRA Regulation Number 8 of 2021. These regulations are pivotal in organizing crypto asset trading on futures exchanges and ensuring compliance within the dynamic landscape of crypto transactions.

However, a recent regulatory shift in supervising crypto activities in Indonesia will transition from Commodity Futures Trading Supervisory Agency (Bappebti) to the Financial Services Authority (OJK), based on UU P2SK.

Related article: 3 New Changes in Indonesia’s Crypto Asset Landscape in 2023

Crypto Trading Ecosystem: A Structured Approach

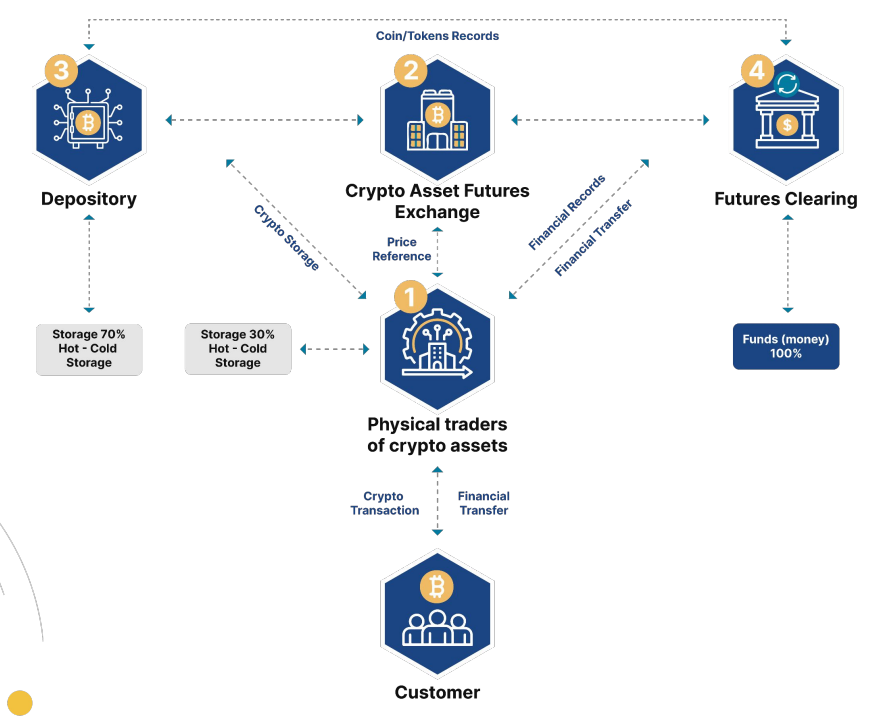

The Indonesian crypto trading ecosystem involves key players like Futures Clearing House and Depository, which manage financial settlements and the storage of customer crypto assets. This structured approach is further enhanced by Self-Regulatory Organizations (SROs) like PT Bursa Komoditi Nusantara or commonly known as CFX, which oversee crypto exchanges Indonesia, ensuring compliance and monitoring of transactions.

32 Registered Local Crypto Exchanges

In 2023, there are 32 registered local exchanges in Indonesia as “Calon Pedagang Fisik Aset Kripto” or Prospective Crypto Exchanges temporary license. a Crypto Exchange, or “Pedagang Fisik Aset Kripto” License is only issued after exchange complete an authorisation process which involves registration with CFX.

If these Prospective Crypto Exchanges are not registered by the specified time, they will not be able to operate in Indonesia.

Expansion of the Crypto Whitelist

In ensuring crypto asset customers’ protection and the continuity of the crypto asset industry with integrity, CoFTRA considers criteria focusing on public ownership, security, scalability, and transparent fund management to determine the crypto whitelist. This list contains crypto assets that can be traded on crypto exchanges.

In a significant regulatory move according to Regulation Number 4 of 2023, CoFTRA updated the crypto whitelist, expanding the number from 383 to 501. This expansion reflects Indonesia’s commitment to customer protection and the integrity of the crypto asset industry.

Anti-Money Laundering and Risk Management

Indonesia’s adherence to the Financial Action Task Force (FATF) guidelines has led Bappebti to establish comprehensive regulations for Crypto Exchanges. These include policies for risk assessment, Anti-Money Laundering/Countering the Financing of Terrorism (AML-CFT), and prevention of Weapons of Mass Destruction (PWMD). Indonesian Crypto Exchanges are required to implement robust monitoring policies and maintain accurate data to ensure the safety and integrity of transactions.

Related Article: 2023 Indonesia Web3 Landscape: Mapping out Industry’s Frontiers